Interviewer: Aco Momcilović, psychologist, EMBA, Owner of FutureHR

Interview with Mirko Sardelić, PhD, Research Associate at the Department of Historical Studies HAZU, Honorary Research Fellow of the ARC Centre of Excellence for the History of Emotions (Europe 1100–1800) at The University of Western Australia; formerly a visiting scholar at the universities of Cambridge, Paris (Sorbonne), Columbia, and Harvard.

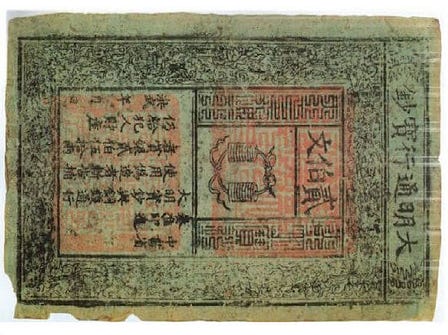

Part 1 is published here: The introduction of cheques was quite an interesting and useful change on the money market. In the Western world the history of cheques can be traced to the very successful Republic of Venice, ruled by merchant capitalist elite. In the 13th century the Republic issued cheques that were used in international trade — replacing huge amounts of silver — which was much more practical, not to mention safe, to transport by ship. Nonetheless, this was not an entirely new invention. Some forms of cheques were used in Mesopotamia, only to be improved upon by Muslim merchants in the Middle Ages. Merchants could exchange silver coins for a piece of paper in Baghdad, one of the most prosperous cities in the world (before it was conquered by the Mongols in 1259), and cash that piece of paper (cheque) in Cordoba (Spain), more than 5,000 km away. The ‘step zero’ of globalisation is also related to financial issues. What we mean by globalisation today is that I can prepare myself a delicious breakfast from Australian avocadoes, Colombian bananas, Spanish lemons, Irish butter and Italian prosciutto — but access to such a wide range of products in our households has been mostly a 20th-century standard. What I mean by ‘step zero’ is the moment when the world became connected for the first time. (Of course, in history, one always needs to be careful with ‘first times’, but I use it here just for the sake of journalism, as there is no place to elaborate contested theories). In the 15th and 16th centuries China had paper money and experienced a monetary crisis mostly due to a shortage of silver. Japan was the biggest exporter of silver before Spain took control of huge silver deposits in the Americas. China needed silver and Spain was a major provider, across the Atlantic. However, in 1571 Manila was founded in the Philippines and overnight became a major transit port. The silk and commodities from China were transported east towards America, while the silver cargo went the other way, over the Pacific Ocean. This ‘silver ring’ connected the Americas with Europe and Asia and the world became more and more financially entangled. Introducing new ideas or technologies into monetary policies is a matter, as ever, of compromise, and it is often a result of embodied interest. There are always advantages and downsides: do we prefer practicality over security issues; or do we favour transparency over the privacy of citizens. Security and privacy issues often change the tune. Q6. We are facing risks of inflation. Today some countries have enormous inflation. Did it happen before? What were the biggest ones? Arguably the most shocking inflations happened in the 20th century. The World wars contributed to those significantly: we can mention Greece and Hungary as examples in the immediate post-WWII period. Nonetheless, Germany’s inflation of 1923 was also terrible — prices doubled every three to four days. WWI reparations were merciless on the German monetary situation. Yugoslavia’s inflation in the early 1990s was also epic. Mementos of these hyperinflations — apart from the terrible trauma of the population who lived through them — still remain in the banknotes of the period: sometimes it can be very hard to count all of the zeroes, e.g., a ten-billion notes were common at the time. In the Roman Empire inflation could be measured through the quantity of (precious) metals in the coins issued by imperial mints. The coins in a strong economy contained a decent amount of gold. This was slowly replaced by a higher percentage of silver, then copper. In ancient times therefore if one wanted to pump more money into the market (or, more often, into financing troops), one could either issue coins of smaller diameter or reduce the percentage of more precious metals in the coins. One of the most famous monetary reformers of the Roman Empire, Emperor Diocletian, tried to restrain galloping inflation by fixing standardised gold and silver coins, introducing bronze coins of smaller value, and issuing the Edict of Maximum Prices. This important document regulated maximum prices for some 1,000 articles across the Empire. The most valuable commodities of the time, according to the document, were one pound of purple-dyed silk and a lion — both items valued up to 150,000 denarii. It was an admirable effort, but these measures were both helpful and detrimental. Nobody has managed to save an empire alone anyway. Q7. Could a country become bankrupt in recent centuries? Humanity has spent a lot of time in war. Wars bring so much devastation that our first thoughts are most often related to arms, casualties, displacements, refugees, hunger, and suffering. Nonetheless, those who want to win wars first think of how to finance them and how to deliver provisions. Financing wars is always a tremendous effort. It was a huge challenge for rulers who often owed a lot of money to rich individuals. They usually found a way to pay them back through other means: giving them land; trading privileges; monopoly over certain commodities; etc. Many rulers lost their thrones (even heads) because their debt was unbearable or other contenders to the throne had more financial means at their disposal. In peacetime and modern times countries go bankrupt as well for various reasons, but it rarely happens as modern times developed mechanisms to give loans to those in financial trouble. Long before money appeared, there was debt. Debt is all around us: citizens of all countries have personal and business loans in banks. Almost all countries in the world have loans; the US national debt reached USD24 trillion (24,000,000,000,000) in April 2020. This is more than the debt of the so-called Third World countries combined. It is a debt towards banks, domestic and foreign investors, and others. One can buy and trade with fractions of national debts. However, the connections between indebted governments, their liabilities and creditors can be rather complex — it is a good topic for another interview by a more competent analyst. Q8. Who were the richest people and how much was their worth? The richest people are those who feel they have enough. You may say this is a philosophical answer, and a pretty dull one, and I cannot agree more. Then again, many essential human achievements require so much of ‘dull’ work. No wonder there are many cartoons and movies that imagine a pill that can skip some thousands of hours of dull training and make (some of) us experts within minutes. There is so much hard work behind pretty much any useful physical or intellectual activity. (Apologies for this red herring, I am often keen to remind my students of Hercules at the crossroads). Back to the richest people in history: pharaohs, emperors, kings, entrepreneurs, bankers — so many whom were both incredibly wealthy and influential. In the Mediterranean world, for many centuries there was a saying ‘wealthy as Croesus’. This unimaginably wealthy Lydian king (6th century BC) arguably was the first ruler to have issued gold coins with standardised purity. Croesus was defeated by another extremely powerful and rich king, Cyrus the Great, who established the Persian Empire, the largest in the world at the time, stretching from the Indus river to the Mediterranean. In the Roman world I could single out two figures: Emperor Augustus, and General Marcus L. Crassus who financed Caesar’s ascent, and died when Augustus was a young boy. Crassus was notoriously rich, and he accumulated his riches “by fire and war” (as Plutarch, one of the finest historians, so nicely put it). He was a military commander and entrepreneur who traded in real estate, among other things. He even had his own fire brigade that extinguished fires in Rome depending on Crassus’ interest, i.e. whether or not he planned to buy that estate. In the common (AD) era, one can mention Emperor Shenzong of the Song Dinasty (11th century); Genghis-khan, the ruler of the largest empire in history (13th century); Mansa Musa I, the King of Mali (14th century) who controlled a considerable cut of the world gold reserves of the period; or Emperor Nicholas II of Russia, whose personal wealth in 1916 is estimated up to 300 billion of today’s US dollars. Jakob Fugger (1459–1525), merchant, banker, and mining entrepreneur, was arguably one of the richest people in history. Some estimates suggest his net worth was several hundred billion in today’s US dollars. This is more than twice as much as today’s wealthiest person, Jeff Bezos, whose wealth has been estimated between USD100 and 200 billion. Of course, this is subject to change, and as early as next year we might be talking about different ratios, or a new richest person on the planet. Three contemporaries John D. Rockefeller, Andrew Carnegie, and Henry Ford, made their fabulous fortunes on oil, steel, and cars, respectively. Their fortunes were more than USD100 billion, each. Carnegie gave an amount equivalent to one billion of today’s US dollars just for building public libraries in the United States of America. Rockefeller made huge donations to the church, and for educational and health purposes. At the turn of the 21st century Bill Gates was for the wealthiest person in the world. He also donated huge amounts to social, educational and health projects. He has been interested particularly in eradicating poliomyelitis, a disease that weakens muscles, and many have been saved from diseases as a direct consequence of his donations to research on viruses and vaccines. Enormous amounts of money very often give birth to greed. Financial reports suggest that eight of the wealthiest people today have accumulated the same amount of money as the poorest half of humanity (which is almost four billion people). Two billion people live on several US dollars a day, and reports estimate that, due to the COVID-19 crisis, another half a billion will be pushed into poverty. These differences, that have deepened over the last couple of decades, could be a big challenge to the global society.

Click here to access the article.